Helexia, a subsidiary of Voltalia (Euronext Paris, ISIN code: FR0011995588), and an international player in the energy transition, announces a key achievement in its growth journey by closing the first tranche of a €90 million, innovating pan-European debt financing.

A pioneer in energy transition since 2010, Helexia provides integrated and customized solutions beneficial to both its clients and the environment. Following the acquisition by Voltalia in September 2019, Helexia multiplied by three its installed capacity and by more than eight its portfolio of long-term photovoltaic contracts.

Today, Helexia confirms its business model strength by having structured a cutting-edge debt package:

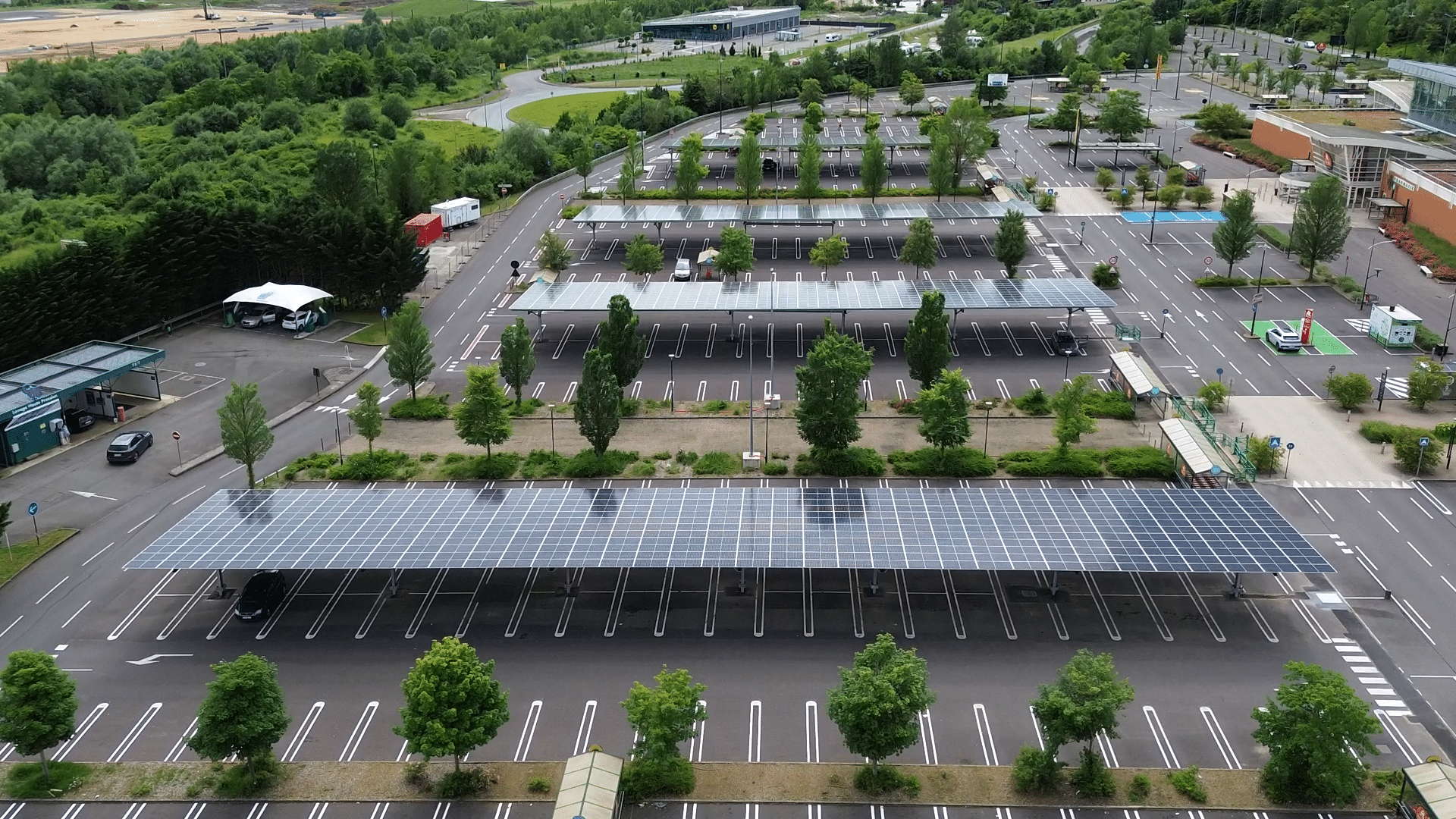

- The facility leverages a portfolio of 350 operating photovoltaic rooftops and solar carports located in four European countries.

- Helexia will have the possibility to add new projects to the financing perimeter as they reach commissioning. It will enable Helexia to finance its growth in France, Italy, Belgium, Portugal, Spain, Poland, Hungary and Romania, and will support the competitiveness of its commercial offers towards clients.

- The assets part to this incremental financing are based by a mix of contractual schemes and counterparty risks, including State-backed PPAs, self-consumption schemes with or without injection of surplus production on the grid, and energy performance contracts.

This financing evidences the capacity of Helexia’s teams to foster innovation, with an eye to support its clients in their energy transition.

This financing is led by La Banque Postale and BPI France, reinforcing the historical long-term relationship with these two partners.

“We are proud of having closed this innovative financing for a multi-client, multi-country portfolio of photovoltaic and energy performance assets.”

Adrien Delion,

Managing Director Finance, Strategy & Digital

“This financing provides a solid foundation for Helexia’s future growth in Europe.”

Benjamin Simonis,

CEO of Helexia